We know how crucial it is to have the right insurance for your vehicle. Comprehensive vehicle insurance is made to shield you from many risks and financial losses. It’s there for you whether you’re driving or parked, ready to face unexpected events like theft, vandalism, or natural disasters.

With comprehensive vehicle insurance, you can rest easy knowing you’re safe from many dangers. At MoneyTadka.com, we help you grasp what comprehensive vehicle insurance covers. We show you how it can really help you.

Key Takeaways

- Comprehensive vehicle insurance protects against various risks and financial losses.

- It covers unforeseen events like theft, vandalism, or natural disasters.

- Having the right coverage provides peace of mind for vehicle owners.

- Comprehensive insurance is essential for protecting your vehicle’s value.

- Understanding your policy can help you make informed decisions.

Introduction to Comprehensive Vehicle Insurance

Comprehensive vehicle insurance is key in protecting your car. It covers many risks not linked to crashes.

Understanding Comprehensive Coverage

Comprehensive coverage is more than just car protection. It helps keep your finances safe. It covers theft, vandalism, natural disasters, and fire.

Having comprehensive insurance can minimize financial losses from unexpected events. To optimize your insurance profile, it’s important to know what comprehensive coverage is and how it helps you.

Why It Matters to Vehicle Owners

For car owners, comprehensive insurance is a safety net. It protects you from natural disasters and vandalism. By managing your insurance well, you get the most from your policy.

Knowing the value of comprehensive insurance helps you make smart choices. It ensures you’re well-protected.

Key Benefits of Comprehensive Coverage

Knowing the benefits of comprehensive coverage can change how vehicle owners think about insurance. It protects against many risks that could harm or lose your vehicle.

Protection Against Theft

Comprehensive coverage is great for protecting against theft. If your car gets stolen, this insurance helps you get it back. It’s especially useful in places where theft is common, giving you peace of mind and financial safety.

Coverage for Natural Disasters

It also covers damage from natural disasters like hurricanes, floods, and wildfires. These disasters can seriously harm your vehicle. With comprehensive coverage, you’re ready for unexpected events, helping you recover faster.

Vandalism and Civil Disturbance Protection

Also, it protects against vandalism and damage from civil unrest. This is reassuring, especially in areas where such incidents happen often. Comprehensive coverage doesn’t just protect your car; it also keeps your finances safe.

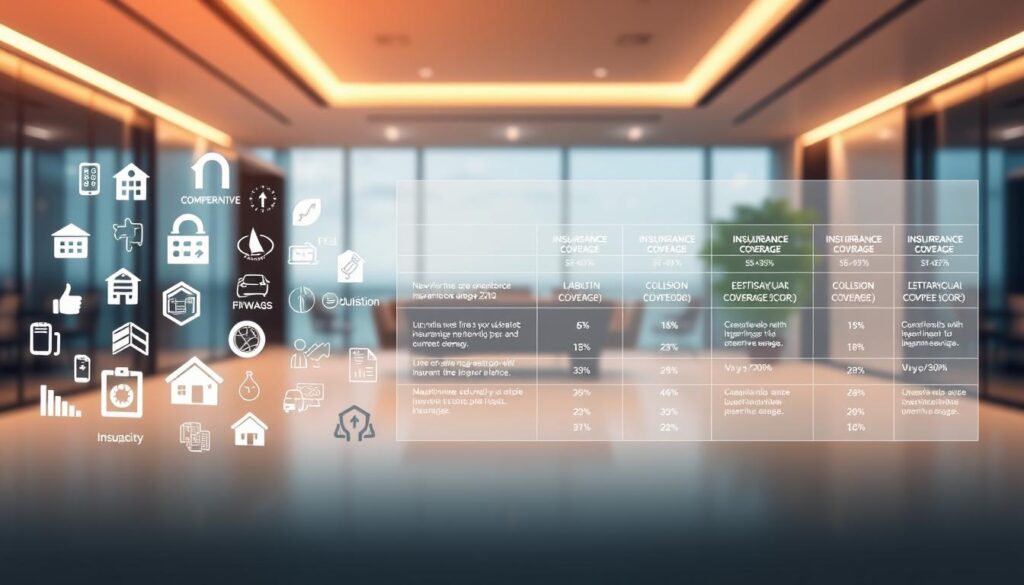

To see how comprehensive coverage stacks up, let’s compare it with other insurance types.

| Coverage Type | Theft Protection | Natural Disaster Coverage | Vandalism Protection |

|---|---|---|---|

| Comprehensive Coverage | Yes | Yes | Yes |

| Collision Insurance | No | No | No |

| Liability Insurance | No | No | No |

As the table shows, comprehensive coverage offers wide protection. It’s a key part of any vehicle insurance policy. Understanding its benefits helps vehicle owners choose the right insurance, keeping them safe from many risks.

What Types of Damage Are Covered?

Comprehensive vehicle insurance covers many types of damage. It’s not just for accidents. It protects against many risks.

Comprehensive vehicle insurance covers damage you can’t control. This includes natural disasters and accidents with animals.

Accidents with Animals

Comprehensive insurance also covers accidents with animals. This includes deer or small animals. It helps pay for repairs if your car is damaged.

Fire and Explosion Damage

It also covers damage from fires or explosions. This could be from wildfires, electrical issues, or terrorism. It covers direct damage and any damage from firefighting.

Insurance experts say comprehensive coverage is key. It protects against unexpected events that could cost a lot.

With comprehensive insurance, you’re safe from many risks. It’s a key part of a good vehicle insurance plan. It helps avoid big expenses from unexpected damage.

Exclusions in Comprehensive Insurance

Comprehensive insurance covers many damages, but it has some exclusions. Knowing these exclusions helps manage expectations and avoid disputes with insurance providers.

What It Doesn’t Cover

Comprehensive insurance doesn’t cover wear and tear, mechanical breakdowns, or maintenance issues. For example, if your car’s engine fails due to age or lack of maintenance, you won’t get help from comprehensive insurance.

It also doesn’t cover damages from acts of war, nuclear hazards, or some natural disasters. This depends on your policy’s terms and conditions.

Common Exclusions:

- Wear and tear

- Mechanical breakdowns

- Maintenance-related issues

- Acts of war

- Nuclear hazards

Common Misconceptions

Many think comprehensive insurance covers everything except collisions. But, there are several exclusions to know about.

Some also believe it covers custom parts or modifications. Unless your policy specifically says so, these are usually not covered.

Some insurance providers offer extra coverage options or riders. You might be able to buy coverage for specific natural disasters or custom parts.

| Exclusion Type | Description | Potential Additional Coverage |

|---|---|---|

| Wear and Tear | Damages due to aging or normal use | Maintenance plans or warranties |

| Mechanical Breakdowns | Failure of mechanical components | Mechanical breakdown insurance |

| Acts of War | Damages resulting from war or civil unrest | Specialized war risk insurance |

“Understanding the fine print of your insurance policy can save you from unexpected surprises when filing a claim.” – Insurance Expert

Knowing what comprehensive insurance covers and doesn’t can help you make better choices. It can also help you avoid unexpected costs.

Factors Affecting Comprehensive Insurance Premiums

Many factors influence comprehensive insurance premiums. It’s key to know what they are. Comprehensive insurance protects vehicles from various risks. But, the cost varies based on several important elements.

Vehicle Make and Model

The make and model of your vehicle greatly affect your premium. Luxury vehicles or those with high theft rates cost more to insure. We look at the vehicle’s market value, repair costs, and theft likelihood.

For example, a high-performance car may have a higher premium. This is because of its value and repair costs.

Driving History and Location

Your driving history and location also matter. A clean driving record can lower your premiums. This shows you’re a lower risk to the insurer.

On the other hand, a history of claims or traffic violations can raise your premiums. Your location also plays a part. Areas with high crime rates or natural disasters have higher premiums.

Knowing these factors helps you make better choices about your insurance. By understanding how your vehicle, driving history, and location affect your premiums, you can save money. For instance, choose a vehicle that’s cheaper to repair or insure. Keep a clean driving record and park in a secure spot to lower your costs.

How Comprehensive Insurance Differs from Other Types

It’s important to know the differences between comprehensive insurance and other vehicle insurance types. Comprehensive insurance covers many risks, but it’s part of a bigger insurance plan.

To understand comprehensive insurance, we need to know about other types like collision and liability insurance. Let’s look at these to see how they differ and work together with comprehensive insurance.

Collision Insurance Explained

Collision insurance helps pay for damages when you crash into something, no matter who’s to blame. It’s especially important for those who own their cars outright or lease them, as lenders often require it.

Key aspects of collision insurance include:

- Coverage for damages from accidents with other vehicles or objects.

- The option to choose a deductible, which affects your premium costs.

- Protection against financial loss due to vehicle repairs or replacement.

Collision insurance is different from comprehensive insurance. Comprehensive insurance covers more risks like theft and natural disasters. Collision insurance focuses on damages from accidents.

Liability Insurance Overview

Liability insurance is key for vehicle insurance. It pays for damages or injuries to others if you’re at fault. It’s required in most states and helps protect your money.

| Type of Insurance | Coverage | Key Benefits |

|---|---|---|

| Comprehensive | Damages not resulting from collisions (theft, vandalism, natural disasters) | Protects against a wide range of risks, providing financial security. |

| Collision | Damages from collisions with other vehicles or objects | Covers repair or replacement costs, regardless of fault. |

| Liability | Damages or injuries to others in an accident where you’re at fault | Protects your financial assets by covering costs associated with damages or injuries to others. |

Knowing the differences between comprehensive, collision, and liability insurance helps you make better choices. For those looking for “insurance services on google,” understanding these types is key to picking the right coverage.

The Importance of Optional Add-Ons

Optional add-ons like rental car reimbursement and roadside assistance offer big benefits. They make our insurance better, giving us more peace of mind and protection. These extras help us deal with unexpected events.

Adding optional features to our insurance is key. These extras give us more benefits. They help us customize our insurance to fit our needs.

Rental Car Reimbursement

Rental car reimbursement is a great add-on. It covers the cost of a rental car while yours is being fixed. This way, you won’t be stuck without a car.

For example, if you’re in an accident and your car needs repairs, this add-on helps. It pays for a rental car, keeping your life on track.

Roadside Assistance Coverage

Roadside assistance is another important add-on. It helps with things like tire changes, fuel delivery, or towing. It’s a big help in emergencies or when you’re far from home.

By adding roadside assistance to your policy, help is just a call away. It makes driving safer and more convenient.

To optimize google business for insurance providers, highlight these add-ons. This attracts customers who want full and flexible insurance. Knowing about these add-ons can greatly improve your insurance experience.

In summary, add-ons like rental car reimbursement and roadside assistance are crucial. They make our insurance better and more personal. By choosing these add-ons, we get a plan that really fits our needs and offers extra security.

How to Choose the Right Coverage Amount

Choosing the right coverage amount for your vehicle is key. It ensures you’re well-protected without spending too much. Several factors influence this choice, like your vehicle’s value and your financial status.

Assessing Your Vehicle’s Value

The value of your vehicle is a big deal when picking coverage. Think about your vehicle’s current market value. Consider its make, model, year, and condition. This helps you decide if you want to insure it for its actual cash value or more.

For example, if your vehicle has expensive aftermarket parts, choose a higher coverage amount. But, if it’s older and has lost a lot of value, a lower amount might be better to save money.

Considering Your Financial Situation

Your financial situation is also important. Think about how much you can afford to pay for premiums and deductibles. It’s vital to find a balance between enough coverage and keeping your finances stable.

If you have a steady income and savings, you might choose a higher deductible to lower premiums. But, if you’re on a tight budget, a lower deductible could be better to avoid financial stress.

In the end, the best coverage amount is one that fits your vehicle’s value and your finances. It should give you peace of mind and protect your wallet.

Steps to File a Comprehensive Insurance Claim

Knowing how to file a comprehensive insurance claim is key for a smooth experience. With comprehensive insurance, you’re covered for many risks, like natural disasters and theft. But, the claim process can be tricky if you’re not ready.

To make it easier, understand what documents you need and the steps to take. Here’s a simple guide to help you through the process.

Documentation Required

When you file a comprehensive insurance claim, having the right documents is crucial. You’ll need:

- Policy documents: Your insurance policy number and details.

- Proof of loss: Evidence of the damage or loss, like photos or a police report.

- Repair estimates: Quotes from repair shops or contractors.

- Additional evidence: Any other documents that support your claim, like witness statements.

Having all your documents ready will make the claims process much easier.

Tips for a Smooth Process

To make the claims process smooth, follow these tips:

- Act promptly: Tell your insurer right after the incident.

- Be thorough: Give detailed info and documents to back your claim.

- Follow up: Keep in touch with your insurer to check on your claim.

- Keep records: Save all your communication with your insurer.

By being prepared and following these steps, you can confidently handle the comprehensive insurance claim process.

Filing a comprehensive insurance claim doesn’t have to be stressful. With the right preparation, your claim will be handled efficiently. This will get you back to normal quickly.

Annual Reviews: Updating Your Coverage

Understanding the role of annual reviews in vehicle insurance is key. These reviews help keep our policies up-to-date and effective. They protect us from various risks.

Annual reviews are more than just checking policy documents. They involve reassessing our needs and understanding market changes. This ensures our coverage is always relevant and informed.

When to Reassess Your Policy

It’s wise to review your vehicle insurance policy every year. Here are some important times to do so:

- Policy Renewal: Check your policy during renewal for any changes in premiums or coverage.

- Change in Vehicle: If you’ve bought a new vehicle, your insurance needs might have changed.

- Life Events: Significant life events, like moving or changes in driving habits, can affect your insurance needs.

Signs You Need More Coverage

There are signs you might need to increase your coverage:

- Increased Vehicle Value: If your vehicle’s value has gone up, you might need to adjust your coverage.

- Changes in Driving Habits: More drivers or changes in how you drive can mean you need more comprehensive coverage.

- New Risks: Facing new risks, like natural disasters, means you might need to enhance your coverage.

Regularly reviewing and updating our vehicle insurance is crucial. It ensures we’re well-protected against unexpected events. It’s also a chance to check that our insurance agency’s Google profile is current. This helps potential clients find and contact us easily.

The Role of Deductibles in Comprehensive Insurance

Understanding deductibles is key when looking at comprehensive insurance. A deductible is the amount you pay before your insurance kicks in. It’s a big part of how insurance works, affecting your costs and what you pay in a claim.

How Deductibles Impact Premiums

The deductible you pick can change your insurance costs a lot. A higher deductible means lower premiums because you take on more risk. A lower deductible means higher premiums because the insurance company takes on more risk.

For example, a $1,000 deductible might lower your premiums compared to a $500 deductible. It’s important to find a deductible that’s affordable but doesn’t make your premiums too high. Think about your financial situation to choose the right deductible.

Choosing the Right Deductible

Choosing the right deductible depends on several things. Consider your financial stability, the value of your vehicle, and how much risk you’re willing to take. For example, a newer, more valuable vehicle might have a lower deductible to save on claim costs.

If you have an older vehicle, a higher deductible might be better because the claim payouts might not be as high. Also, think about your driving habits and how likely you are to need to file a claim. Safe drivers with low accident risk might choose a higher deductible to save on premiums. The goal is to find a deductible that fits your financial situation and comfort with risk.

Frequently Asked Questions About Comprehensive Insurance

It’s important to clear up any confusion about comprehensive insurance. We’re here to help you understand it better. This will help you make smart choices about your vehicle.

Clarifying Common Doubts

Many people wonder about comprehensive insurance. They ask what it covers and how it’s different from other insurance types. Let’s tackle some of these questions.

- What does comprehensive insurance cover? It protects your vehicle from damage not caused by a crash. This includes theft, vandalism, natural disasters, and fire.

- Is comprehensive insurance mandatory? No, it’s not required. But, it’s a good idea if you have a loan or lease on your vehicle.

- How is comprehensive insurance different from collision insurance? Comprehensive insurance covers non-crash damage. Collision insurance covers damage from a crash.

Experts say, “Comprehensive insurance offers wide protection for vehicle owners. It covers many risks not linked to crashes.”

“Having comprehensive insurance can give you peace of mind. It means your vehicle is safe from many potential damages.”

Additional Resources for Vehicle Owners

For more info on comprehensive insurance, check out online resources. Google My Business is a great place to find insurance providers and read reviews.

| Resource | Description | Link |

|---|---|---|

| Google My Business | Find insurance providers and read customer reviews | https://www.google.com/business/ |

| Insurance Comparison Websites | Compare insurance quotes from different providers | Example: https://www.insurance.com/ |

By learning about comprehensive insurance and using online resources, you can make smart choices. This will help you protect your vehicle.

Conclusion: The Importance of Comprehensive Coverage

Comprehensive vehicle insurance is key to protecting your car from many risks. Knowing what it covers helps you choose the right insurance. This way, you can make smart choices about your car’s safety.

Having the right insurance means you’re financially safe and worry-free. For insurance companies, being visible online is very important. Making your Google Business Profile shine can really help you stand out in the insurance world.

Protecting Your Investment

Comprehensive coverage is more than a policy; it’s a shield for your car. By picking the right coverage and knowing what affects your premiums, you keep your car safe from surprises.

Think about checking your insurance policy to see if it fits your needs. This way, you’ll be well-protected on the road. Insurance companies will also benefit from a great Google Business Profile, drawing in more customers.